6615352626 Key Strategies for Personal Finance Management

Effective personal finance management is essential for achieving financial stability and freedom. Key strategies include understanding cash flow, tracking expenses, and setting clear financial goals. By categorizing expenditures and prioritizing needs, individuals can identify spending patterns and allocate resources more effectively. Furthermore, the development of a diversified investment portfolio can enhance long-term security. Exploring these strategies reveals deeper insights into managing finances and achieving desired outcomes. What specific approaches can lead to more effective financial decision-making?

Effective Budgeting Techniques

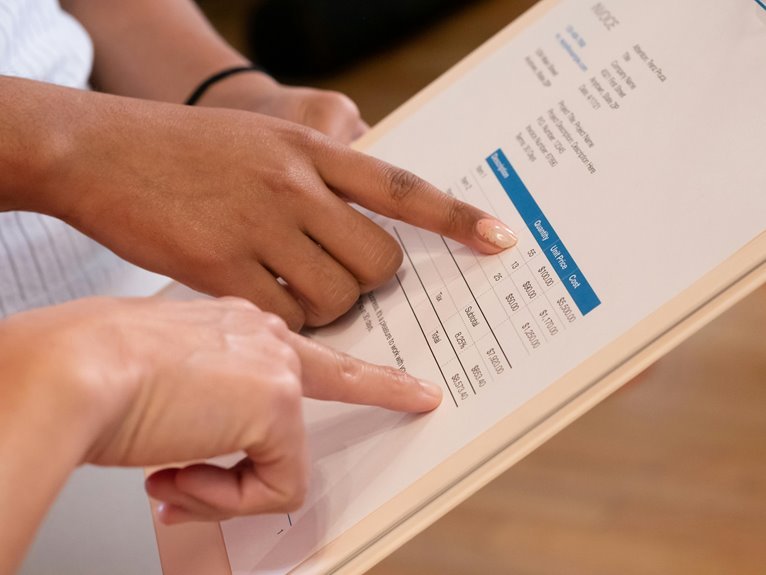

Although many individuals aspire to achieve financial stability, effective budgeting techniques often remain elusive.

Successful budgeting hinges on understanding cash flow and implementing rigorous expense tracking. By categorizing expenses and monitoring inflows and outflows, individuals can identify spending patterns, prioritize needs, and allocate resources more effectively.

This disciplined approach not only fosters financial awareness but also empowers individuals to take control of their financial futures.

Smart Saving Strategies

While many individuals recognize the importance of saving, implementing smart saving strategies can often be a challenging endeavor.

Establishing a robust emergency fund is crucial, providing a financial buffer against unexpected expenses.

Additionally, utilizing high yield savings accounts allows individuals to maximize interest earnings, enhancing their savings potential.

Together, these strategies empower individuals to achieve financial stability and greater freedom in their financial lives.

Strategic Investment Approaches

Many investors overlook the significance of developing strategic investment approaches that align with their financial goals and risk tolerance.

Implementing diversified portfolios can mitigate risks while maximizing potential returns. A thorough risk assessment is essential for identifying suitable investment avenues, enabling individuals to navigate market volatility effectively.

Conclusion

In the realm of personal finance management, individuals navigate a complex maze, much like Theseus guided by the thread of Ariadne. By employing effective budgeting techniques, smart saving strategies, and strategic investment approaches, they can chart a clear path through potential pitfalls. This holistic framework not only illuminates their financial journey but also empowers them to reach their desired goals. Ultimately, with disciplined practices, they can transform their financial landscape into a thriving garden of security and freedom.